18 housing trends that defined the year, including record mortgage rates, depleted inventory, and dwindling home sales

2023 was a difficult year for the housing market. It started with a continuation of negative trends from the end of 2022 and turned into the least affordable year for home buying on record.

Seasonal trends buckled. The spring homebuying season never happened, housing inventory remained historically low throughout the year, and sales plummeted.

The market was so difficult that more than half of recent homebuyers believed buying a home was more stressful than dating, and nearly 40% of homebuyers under 30 received money from their family to afford a down payment.

So what happened? In short: Record mortgage rates, high inflation, and persistently high housing and rental prices. But there was a lot more to it as well.

Below are trends, data points, and visuals that defined the 2023 housing market.

All data is aggregated from January through November 2023, and does not include December unless otherwise stated. December data is through the 15th of the month. All data is from Redfin, FRED, NAR, and/or public records. For questions about metrics, read our metrics definitions page.

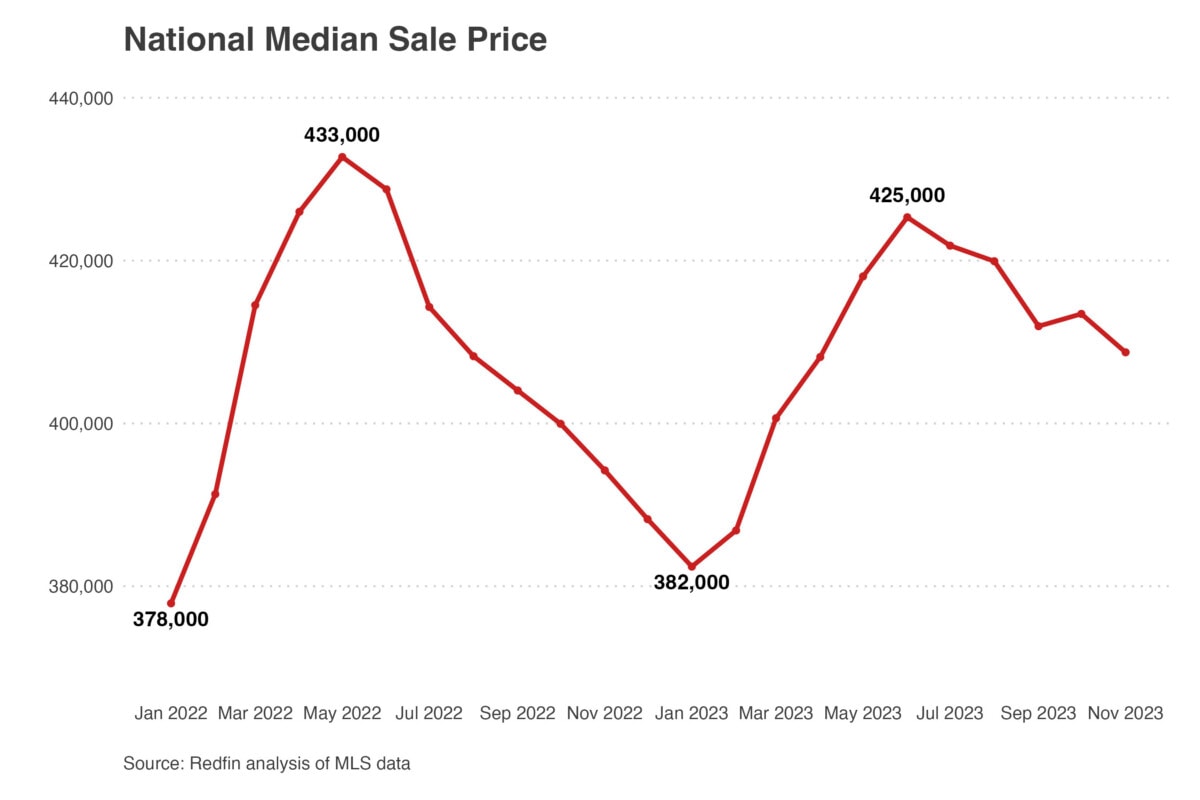

1. Home prices rose to near-record highs

The U.S. median sale price peaked at $425,000 in June, just below last year’s record high of $433,000. However, when averaging over the entire year, 2023’s average median sale price was higher than any previous year in history, rising from $407,000 in 2022 to $409,000.

“The unusual combination of low supply and low demand caused home prices to remain elevated throughout the year, which was bad news for pretty much everyone,” laments Daryl Fairweather, Redfin Senior Chief Economist. “The market was extraordinary; it felt hot, even though very few homes changed hands.”

2. San Francisco was the most expensive metro area for homebuyers in 2023

Still the most expensive metropolitan area (metro) in the country, the median sale price of a home in San Francisco was $1,446,000 in 2023, down 4.2% year over year.

- The top six most expensive metros were all in California.

- Milwaukee saw the largest year-over-year price increase in the country, rising 8.8%.

- Three Florida metros were among the ten metros with the largest year-over-year increases: Miami (8.4%), West Palm Beach (7.6%), and Fort Lauderdale (7.2%).

The top ten most expensive metros to buy a home in 2023

| Metro | Median sale price | Year-over-year change |

| San Francisco, CA | $1,446,000 | -3.4% |

| San Jose, CA | $1,431,250 | +0.5% |

| Anaheim, CA | $1,029,000 | +3.9% |

| Oakland, CA | $903,000 | -4.8% |

| Los Angeles, CA | $846,000 | -0.7% |

| San Diego, CA | $845,000 | +3.5% |

| Seattle, WA | $766,000 | -1.3% |

| New York, NY | $684,500 | +0.4% |

| Boston, MA | $677,500 | +4.4% |

| Nassau County, NY | $617,400 | +1.8% |

Data includes the yearly median sale prices out of all homes sold in each of the 50 largest metropolitan areas. Data does not take into account local median incomes and home affordability.

3. Detroit was the least expensive metro area for homebuyers in 2023

The median sale price for a home in Detroit was $173,450 in 2023, down 2.7% year over year. Even though prices fell in 2023, homes in Detroit are more expensive than they were before the pandemic, as an influx of people searching for affordability have pushed up prices.

“Home prices remained fairly stable in Detroit and even rose in some areas,” says Anne Loehr, a Detroit Redfin agent. “However, across the city, recently updated homes went for the most money.”

- Eight of the most affordable U.S. metros saw prices rise as homebuyers pounced on less expensive housing.

- Nine of the ten least expensive metros were all located in the Rust Belt, a geographic region near the Great Lakes and Appalachians.

- Three pandemic homebuying boomtowns saw the largest year-over-year price drops: Austin (-9.7%), Oakland (-4.8%), and Phoenix (-3.9%).

The top ten least expensive metros to buy a home in 2023

| Metro | Median sale price | Year-over-year change |

| Detroit, MI | $173,450 | -2.7% |

| Cleveland, OH | $204,800 | +2.3% |

| Pittsburgh, PA | $218,400 | +1.1% |

| St. Louis, MO | $246,700 | +3.6% |

| Philadelphia, PA | $264,150 | -1.9% |

| Cincinnati, OH | $270,400 | +7.5% |

| Warren, MI | $285,600 | +4.1% |

| Indianapolis, IN | $290,350 | +5.2% |

| Milwaukee, WI | $299,250 | +8.8% |

| Kansas City, MO | $310,200 | +3.9% |

Data includes the yearly median sale prices out of all homes sold in each of the 50 largest metropolitan areas. Data does not take into account local median incomes and home affordability.

4. Rent prices remained historically high but stopped short of new record

The median U.S. rent price hit $2,050 in August 2023, matching the record price of $2,050 set in August 2022. Year-over-year price changes were flat until November when they dropped significantly, as an increase in inventory and vacancies forced landlords to hold rents steady or drop them. Other contributors to the quieter rental market: Strong new construction in the apartment industry, and fewer new households forming (two or more people living together).

“November provided the most relief for renters,” says Maggie McCombs, managing editor of Rent., a Redfin company. “Prices dropped by 2.1%, marking the first time in more than three and half years that prices fell by more than a single percent. We expect decreases to continue into 2024.”

This was in stark contrast to the past two years, which went from sudden growth during the pandemic to a free-fall in the second half of 2022.

“One of the biggest changes compared to 2022 was the slowdown in the rental market,” adds Fairweather. “Last year, rent prices skyrocketed in the first half of the year due to low supply and high demand. However, in 2023, supply began to catch up, causing many landlords to keep prices flat amid higher vacancy rates.”

Even though growth slowed, the average rent price for all months through November in 2023 rose $10 to $1,992, the highest in history. This only worsened the affordability crisis across the country, especially for lower income families. Rent growth has outpaced wages for decades, but the most recent data states that the average renter now spends 30% of their income or more on rent.

The U.S. currently has a shortage of 7.3 million affordable housing units for those who need them, and no state has an adequate supply.

Data includes the 2023 average aggregated median rent prices for each of the 50 largest core-based statistical areas (CBSAs) compared to 2022 data from the same period.

5. Inflation remained stubbornly high before finally falling

The prices of goods and services rose 6.6% year over year in February, just below 2022’s high and the second-highest inflation level since August 1982. Inflation then fell steadily throughout the year, albeit still above healthy levels.

As interest rates hovered around 0.5% for the entirety of the pandemic, inflation took off due to supply crunches and increased consumer demand. The Fed raised its benchmark rate in 2022 to combat inflation and cool the economy – that began working this year, but higher interest rates led to higher mortgage rates, which slowed the housing market. Interest remains high as we end 2023, but economists expect them to start coming down next year.

- Since the Fed began raising the target rates in March 2022, they have increased it 11 times to the current range of 5.25-5.5%.

- Inflation remained highest in pandemic boomtowns due partly to the sudden jump in house prices, which is a key contributor to inflation.

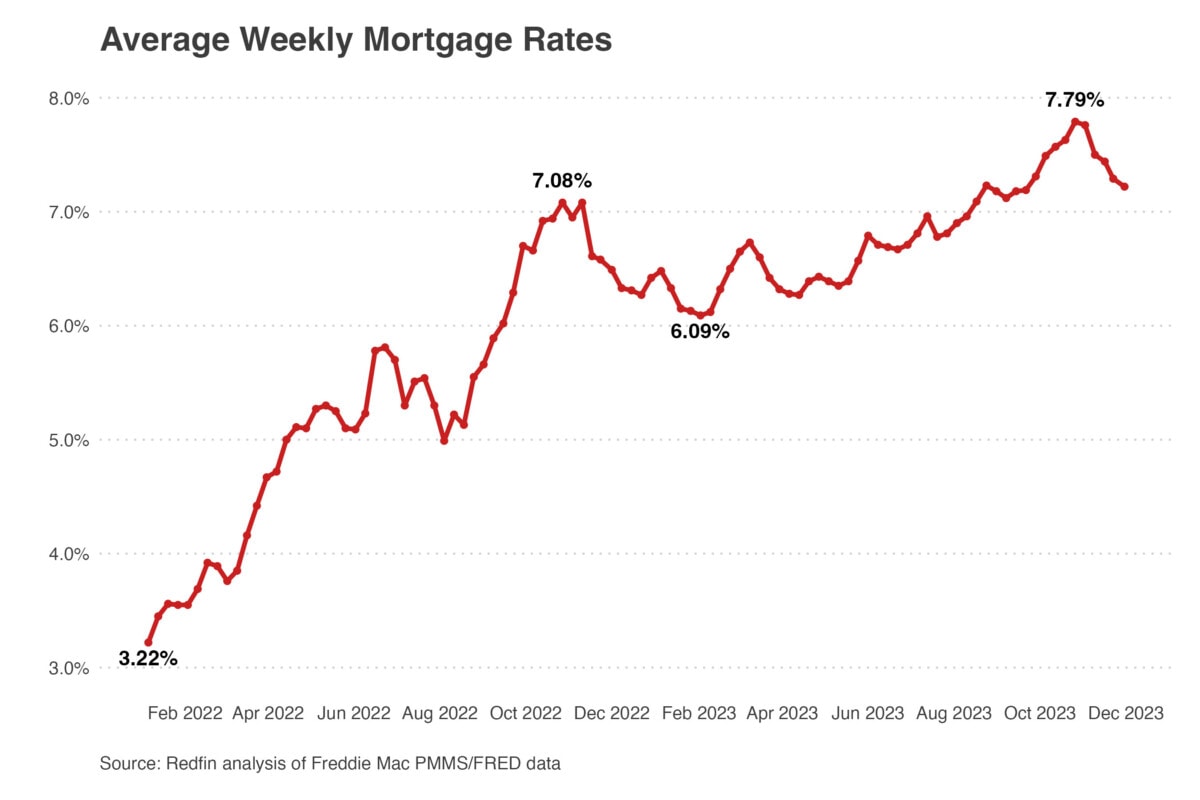

6. Mortgage rates ballooned beyond 8% for the first time in over 20 years

“Mortgage rates were the name of the game this year as record inflation helped push daily average 30-year fixed rates past 8% for the first time since 2000, pricing many buyers and sellers out of the market,” says Fairweather. “Home buyers didn’t want to pay twice as much for a home than they would have three to four years ago, and home sellers didn’t want to give up their pre-pandemic rates.”

Higher mortgage rates impacted affordability across the market, straining already sapped budgets. In July, the average monthly mortgage payment reached $2,637 and grew more than twice as fast as wages (12.6% compared to 5.2%). Both were record highs. Affordability (or lack thereof) also directly affects housing inequality, which is wider now than it was in the 1960s.

Importantly, mortgage rates fell noticeably before the end of the year due to inflation easing up, the Fed holding rates steady, and the labor market growing slower than expected. While interest rates aren’t predicted to fall until midway through next year (three rate drops are predicted in 2024), mortgage rates could continue to fall sooner.

“Looking ahead, whether interest rates will fall depends on two things: the strength and resiliency of the economy, and consumer behavior,” notes Matt Birdseye, Executive Vice President at Bay Equity, a Redfin company. “Until unemployment rises and the economy slows, rates are unlikely to fall.”

- Just 16% of homes were affordable for the typical household in 2023, likely the lowest for the foreseeable future.

Graph shows aggregated average mortgage rates, not daily rates, which is why the graph does not depict the 8% high. Daily rates are more variable.

7. Homebuyers looking to relocate favored sun and affordability

A record 26% of homebuyers looked to move to a different metro area in the three months ending August 2023, up from 24% during the same three months in 2022 and 25% at the beginning of this year.

“Generally speaking, the proportion of buyers looking to relocate was higher in 2023 than in 2022,” notes Chen Zhao, Redfin Senior Economist. “Despite buyer demand falling overall, those who looked to buy sought more affordable locations to get more for their money.”

Surprisingly, the risk of natural disasters didn’t push home prices down in many at-risk metros. “We expect this to change in the near future, though,” continues Zhao.

Many of the top migration hotspots were sunny, more affordable metros which grapple with severe climate risks such as heat, drought, and flooding. This is not new; in fact, from 2021-2022, migration into the most flood-prone areas doubled compared to the prior two years. This comes as 2023 set a new record for billion-dollar weather disasters.

“It’s human nature to focus on current benefits over costs that could rack up in the long run,” admits Daryl Fairweather. “In short, the consequences of climate change haven’t fully sunk in. This is partly because most homeowners don’t foot the bill when disaster strikes. But as insurers continue to pull out of disaster-prone areas, people may feel a greater sense of urgency to mitigate climate dangers – especially if their home’s value is at risk of falling.”

- Las Vegas, Miami, and Sacramento, metros where 100% of homes are at extreme risk of dangerous heat, were the top migration hotspots.

- Homebuyers left expensive coastal metros like San Francisco and New York more than anywhere else, continuing the pre-pandemic-era trend.

- More people looked to leave rather than move to Austin for the first time on record, due to rising costs of living, inflated house prices, and return to work mandates.

The top five most popular metros people looked to move to in 2023

| Metro | Number of people looking to move to the area |

| Las Vegas, NV | 5,565 |

| Miami, FL | 5,240 |

| Sacramento, CA | 5,125 |

| Phoenix, AZ | 4,770 |

| Orlando, FL | 4,595 |

The top five most popular metros people looked to leave in 2023

| Metro | Number of people looking to leave the area |

| San Francisco, CA | 28,365 |

| New York, NY | 23,710 |

| Los Angeles, CA | 20,640 |

| Washington, D.C. | 15,590 |

| Louisville, KY | 5,195 |

Data is the percent of Redfin.com users searching for homes outside their metro. Data is the annual median aggregate of multiple three-month rolling aggregates. Keep up with the latest migration news here.

8. Housing inventory remained well below average

There was an average of 1.015 million homes listed for sale every month in 2023, down 0.1% from last year. Monthly inventory peaked at 1.1 million homes, below 2022’s 1.26 million and far below historical normals.

Cincinnati (-41.9%), Newark (-24.3%), and New Brunswick (-21.9%) saw the biggest inventory declines, with Chicago coming in fourth.

Mortgage rates were the primary reason why inventory was so sluggish. Nearly a quarter of all homeowners had an interest rate below 3%, and around 90% of homeowners had rates below 6%, leading many would-be sellers to stay put to avoid taking on a higher rate.

Inventory is calculated in rolling 90-day periods, e.g., January 2023 data is the three-month period from November 1, 2022, through January 31, 2023. Redfin inventory records date back to 2012.

9. New listings dropped to their lowest level on record

There were just 5.4 million new listings in 2023, the lowest level on record and a massive 16.4% drop from 2022. Average monthly new listings also posted sharp declines, falling from 585,000 in 2022 to 520,000 this year.

New listings are one factor that make up total housing inventory. The dramatic drop in new listings was primarily due to skyrocketing mortgage rates, keeping buyers and sellers on the sidelines.

Year over year, new listings fell every month in 2023 until November, when they began to rise for just the second time since July 2022. That same month, they also posted their biggest increase since 2021 as mortgage rates fell to under 7.4%, well below the high of 8%. Listings continued to rise into December.

This year, new listings were also a major factor in determining local market trends. For example, new listings dropped a massive 24% across New York State in 2023, causing a ripple effect. “The drop in new listings created a surge in competition among buyers looking for affordable homes,” says Kimberly Hogue, a Rochester Redfin agent. “Sellers were able to benefit massively in many Upstate markets as buyers competed over the few homes left, leading to a spike in prices.”

Joey Keeler, a Redfin Premier agent in Seattle, agrees, but says that favorability depends on the property. “Generally, our market favors sellers, but it depends on the listing,” he says. “Some well-priced homes can see multiple bidding wars, while others may sit on the market for weeks.”

- New listings posted year-over-year gains to close out the year, providing hope for 2024.

New listings are calculated in rolling 90-day periods, e.g., January 2023 data is the three-month period from November 1, 2022, through January 31, 2023. Redfin listings records date back to 2012.

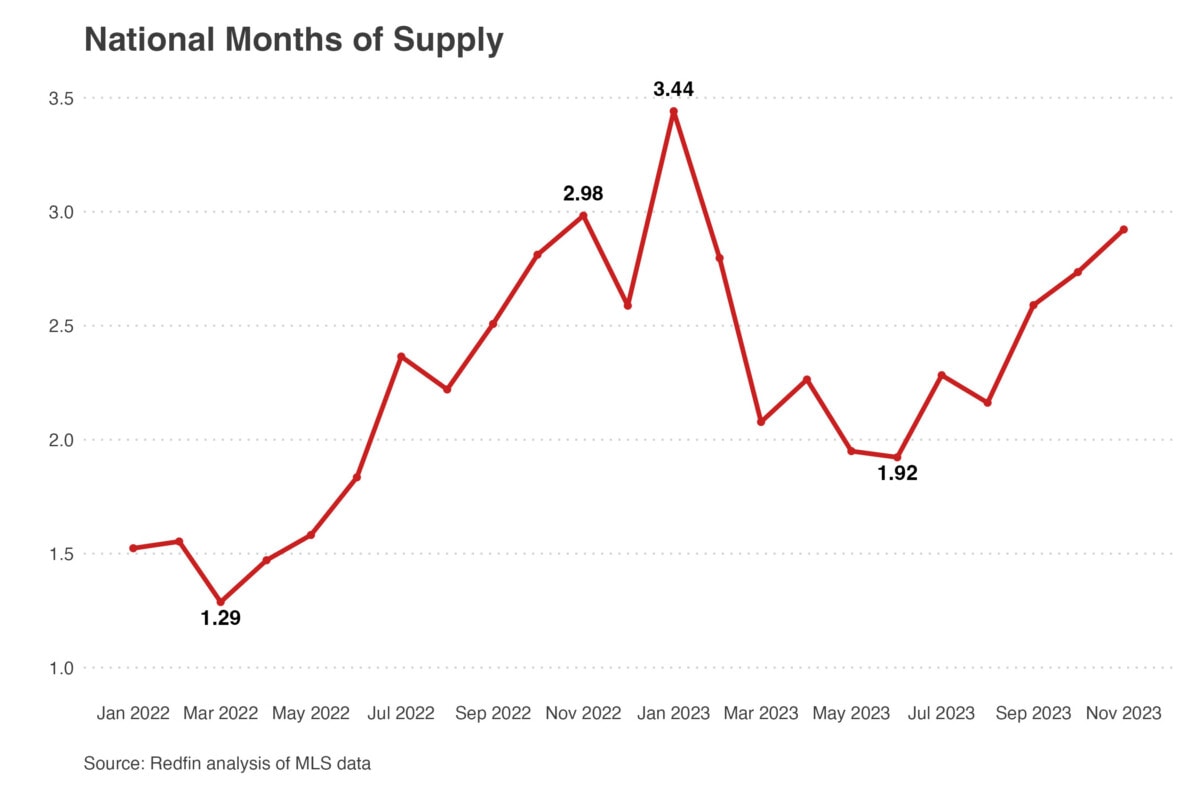

10. Months of supply reached 3.4 months, its highest level since 2019

While inventory measures the number of homes currently available for sale, months of supply measures the amount of time it would take those homes to sell. Six months of housing supply is considered a healthy benchmark, with fewer than six indicating a seller’s market and more than six indicating a buyer’s market.

The average stock of housing supply across every month in 2023 was 2.4 months, up from 2.1 months in 2022.

Even though months of supply rose in 2023, it was still a very tight market; through the first six months of the year, just 1.4% (14 out of 1000) of the nation’s homes changed hands, the lowest share in at least a decade. The pandemic homebuying boom depleted supply, which has only barely started to recover.

“Months of supply gained some ground this year compared to last, reaching above 3 months in January, but still remained far below a balanced market,” adds Fairweather. “However, local market trends determined whether or not buyers or sellers had an advantage.”

- Months of supply grew at its fastest rate year over year in history in January before falling until April.

- Even though months of supply began increasing to close out the year, it still remained below a balanced market.

Supply is calculated in rolling 90-day periods, e.g., January 2023 data is the three-month period from November 1, 2022, through January 31, 2023. Redfin supply records date back to 2012.

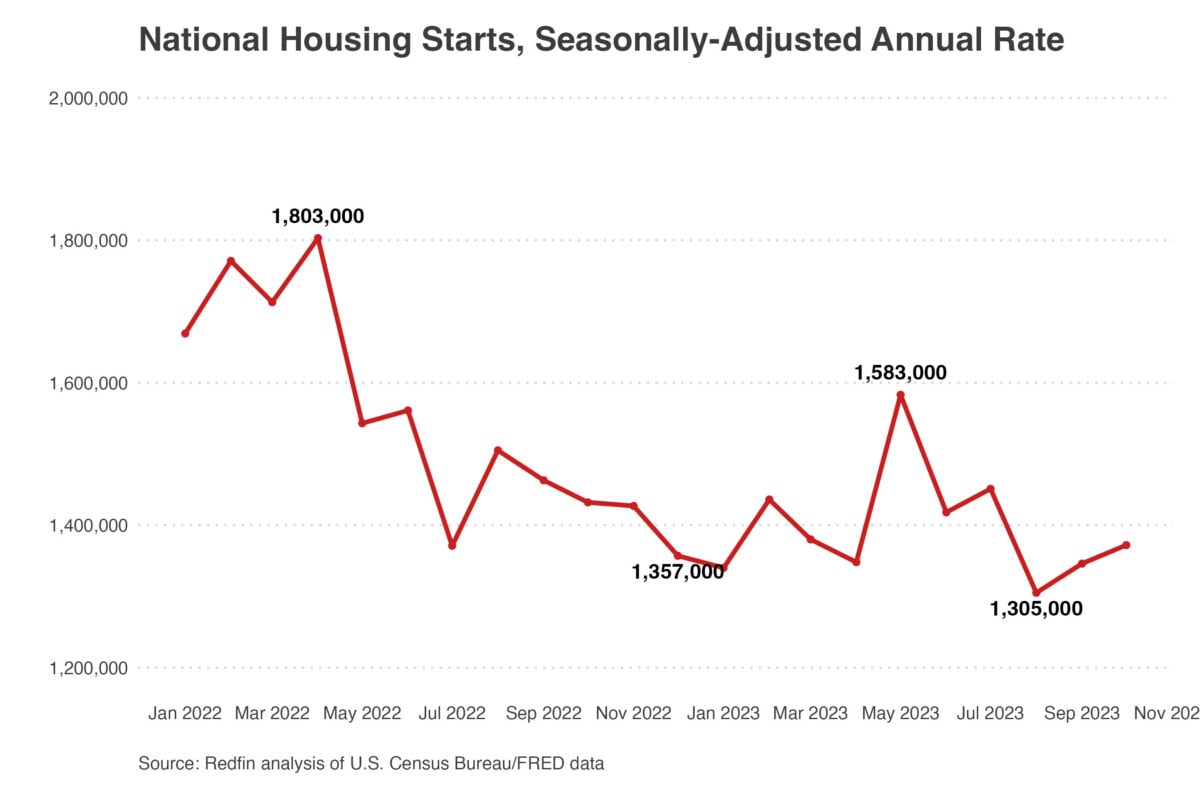

11. New construction fell as builders were left stuck with inflated inventory

There were 1.41 million privately-owned new homes built in the U.S. through November 2023, down from 1.55 million in 2022.

Many home builders who snatched up land during the pandemic to capitalize on the supply crunch were left stuck with homes they couldn’t sell this year. This is a stark difference from 2022, when new construction blossomed following the pandemic supply crunch.

“If you’re a buyer, consider new construction homes,” advises Kim Stearns, a Northern Idaho Redfin agent. “Because of an inventory buildup, many builders have one to four homes they would love to close on and will often offer incentives.”

New construction slowed before rising later in the year, as inflation cooled and more homebuyers entered the market. Experts predict new construction will continue rising into next year.

- Over 73% of new builds were single-family homes, up 8% year over year.

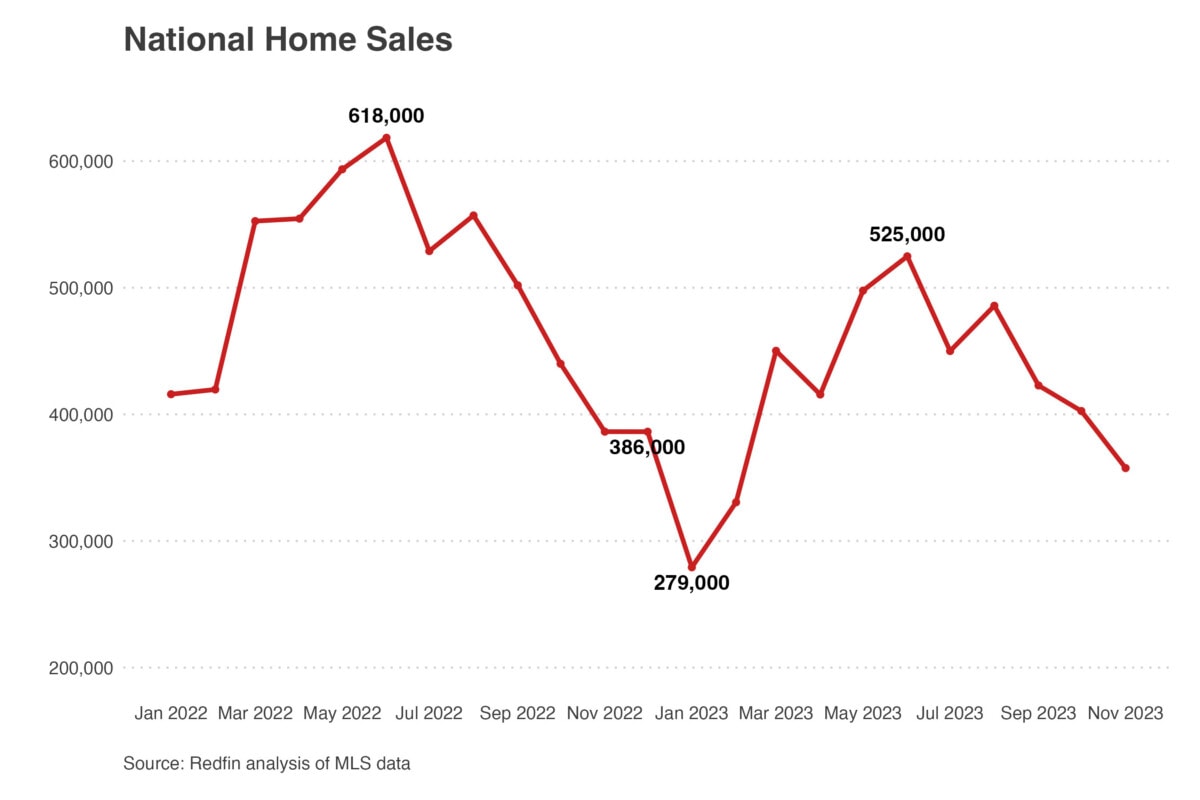

12. Home sales fell more than 18%, hitting record lows

Just 4.59 million U.S. homes sold through November, an incredible 18.3% drop from the 5.62 million sold in 2022 during the same period.

Year-over-year home sales were negative every month in 2023. However, the declines shrunk from a low of -37.5% in January to just -4.8% in November, showing a promising upward trend leading into 2024.

Unfortunately, existing home sales, a measure of how many homes that have sold at least once are expected to sell in a year, have fared much worse. In general, between four and seven million existing homes sell per year, with the historical average sitting at just over 5 million. In 2023, experts predict just 3.82 million existing home sales, a 7.3% drop from 2022 and the lowest annualized amount since August 2010.

- Just 278,000 homes sold in January, the lowest amount since 2012.

- In May, the number of active listings dropped to 1.4 million, its lowest level on record. Fewer listings helps boost bidding wars and further deter buyers, impacting sales.

- While pending sales rose in November, closed sales fell through at a record rate to close out the year.

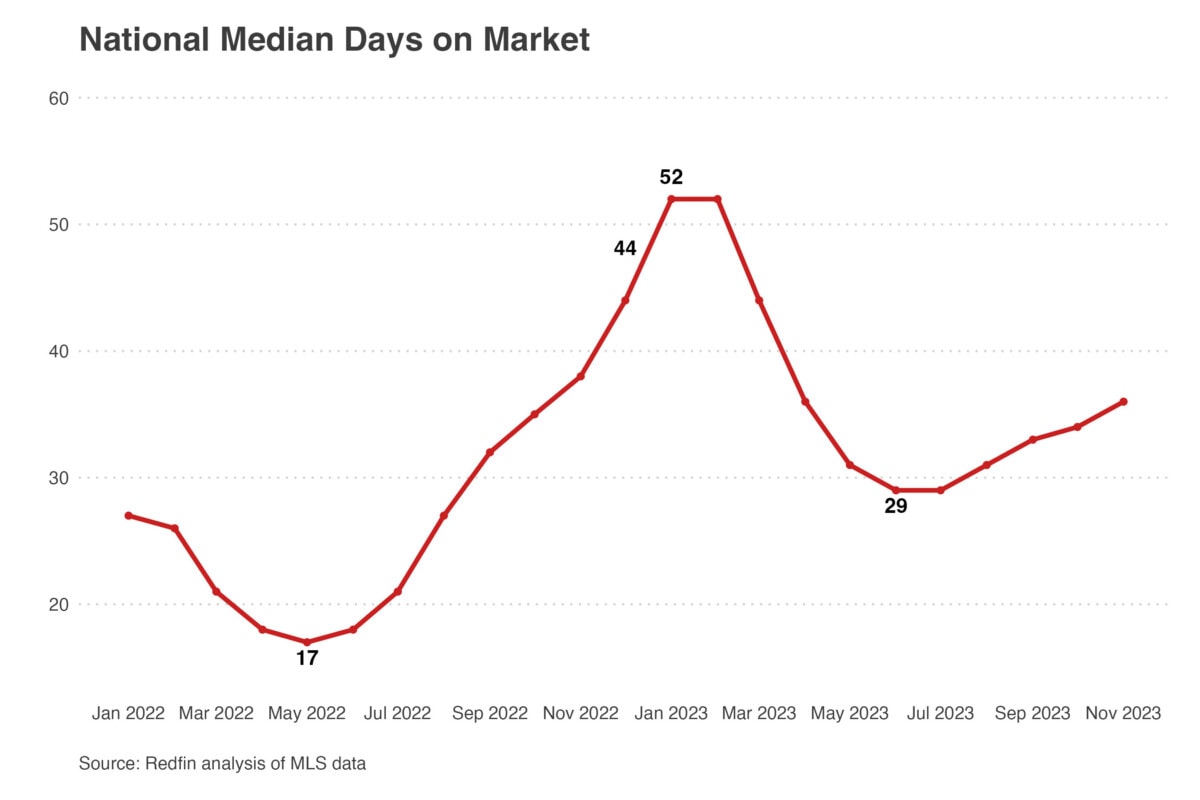

13. Median days on market soared beyond one month as the market cooled

In 2023, homes spent an average of 37 days on the market, a full ten days more than 2022.

Supply started dropping dramatically during the pandemic due to supply chain issues, rising demand, and a chronic lack of homebuilding. However, supply began inching upwards part way through 2022, as mortgage rates rose and fewer people entered the market.

In 2023, slowly rising supply paired with high home prices and mortgage rates led to an increase in time on market in most metros. However, more affordable areas saw the opposite effect; midway through 2023, houses in Buffalo and Rochester sold over six times faster than homes in Austin.

“Inventory for Austin is currently sitting at an 8-year high, which corresponds with an increase in time on market,” observes Chris Daniels, a Redfin Sales Manager in Austin. “Inventory has climbed gradually throughout 2023, but many indicators are pointing towards this being the peak due to lower mortgage rates luring people back to the market.”

- June and July were the busiest months of the year, with homes spending 29 days on the market.

- By far, the slowest month was January, with homes spending an average of 52 days on the market.

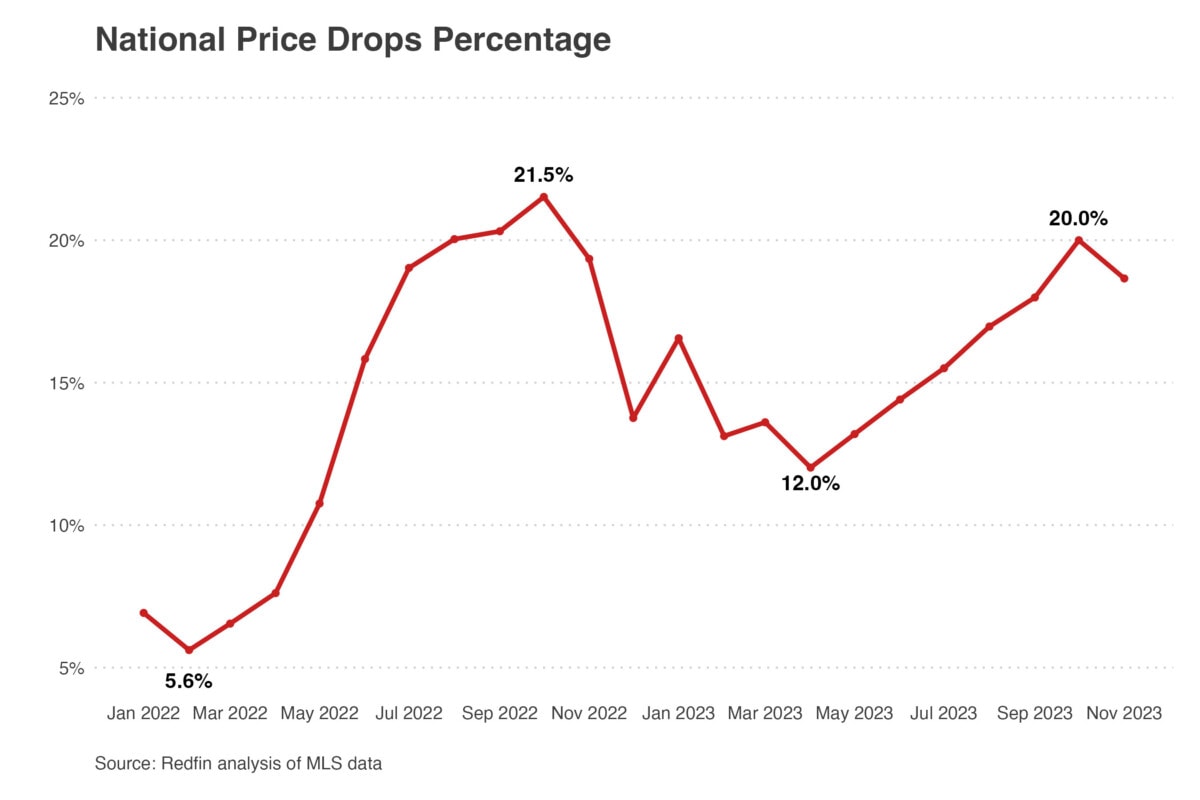

14. 15% of active listings experienced price drops

15.3% of listings experienced price drops in 2023, up from 13.9% in 2022.

As affordability worsened and fewer buyers entered the market, more sellers were forced to lower prices. In some markets, sellers also had to offer additional concessions due to very limited demand. In fact, by November, more than one-third of all home sellers gave concessions – down from the record 45.6% in February but up from 27.6% two years prior.

“A great way buyers can lower the cost of a home is through seller concessions and buydowns,” advises Mike S. Rafii, a Regional Sales Manager at Bay Equity. “A common way to do this is by negotiating seller concessions to include money toward the buyer’s closing costs. The buyer can then use this money to buy down their interest rate – either permanently (for the entire mortgage term), or temporarily (for up to 3 years).”

In many markets, sellers need to do everything they can to secure a buyer. “To make a property more appealing, sellers need to have their homes in pristine condition to attract buyers,” suggests the Redfin Premier agents in Las Vegas. “In Las Vegas, sellers had to do everything under the sun, from paying closing costs to offering repairs, to get a luxury buyer this year.”

- On average, price drops remained more common than any year on record, as limited affordability hampered buyers’ budgets.

- Of all sellers who dropped their original listing prices in 2023, the average seller dropped prices by 4.5%.

-

The top five metros with the highest share of price drops in 2023

| Metro | % of homes with price drops |

|---|---|

| Indianapolis, IN | 39.9% |

| Denver, CO | 39.8% |

| Tampa, FL | 37.5% |

| Austin, TX | 35.9% |

| Cincinnati, OH | 35.4% |

Data includes the aggregated average percentage of price drops out of all active listings in each of the 50 largest metropolitan areas.

15. Nearly 33% of homes were purchased with cash in 2023

32.7% of homes were purchased with all cash in 2023, up from 30.7% last year and the highest share in a decade. However, while the share of all-cash purchases continued rising, the number of cash sales fell year over year alongside all other sales metrics.

Affluent home buyers who can afford to pay cash are more apt to buy when mortgage rates are high. By paying all cash, they avoid interest rates altogether and secure a better deal. While these are helpful benefits, they also exacerbate inequality between people who own homes and people who don’t.

Cash purchases were especially common at higher price points. “The luxury market experienced a large influx of cash buyers this year, due to higher mortgage rates,” notes Jonathan Huffer, a Redfin Premier agent in Palm Beach.

- In September, 1 in 3 homebuyers were paying all-cash, the highest share since 2014.

- Inexpensive metros and top migration destinations saw the highest share of cash purchases.

- Many of the most expensive metros saw the fewest all-cash purchases, including Oakland (17.3%), San Jose (19.1%), and Seattle (20.4%).

The top five metros with the highest share of all-cash purchases in 2023

| Metro | % of homes purchased with all-cash |

|---|---|

| Cleveland, OH | 51.9% |

| West Palm Beach, FL | 51.2% |

| Jacksonville, FL | 47.9% |

| Cincinnati, OH | 44.4% |

| Miami, FL | 42% |

Data is from a Redfin analysis of county records across 39 of the most populous U.S. metropolitan areas, dating back through 2011.

16. Luxury home sales experienced their largest year-over-year decline on record

In 2023, there were 549,750 luxury homes sold, down 23.8% year over year.

In January, luxury home sales fell a record 45% to their second-lowest level ever, continuing a rapid decline from 2022. Year-over-year sales remained negative every month, but slowly rose as the year went on. An average of 53,200 luxury homes sold per month in 2023, down 10.5% year over year.

Even as sales fell, luxury house prices continued to grow this year, topping $1.15 million in September, a new record and higher than any point in 2022. Nationwide, luxury home prices grew nearly three times faster than non-luxury prices but dropped in expensive metros as people migrated to more affordable areas.

Higher prices also meant less competition. “Higher prices weeded out many buyers in the luxury market and dropped competition nationwide,” notes Sam Chute, a Redfin Premier agent in Miami. “However, homes that did sell often sold quickly.”

- Oakland, Seattle, and San Francisco saw the largest price decreases but remained among the most expensive metros.

- New Brunswick, NJ was the fastest growing luxury market, with prices rising by 11.7% year over year.

- New York City (-35.4%), Providence (-28.3%), and Miami (-28.3%) had the largest luxury sale declines.

- Just two metros saw an increase in luxury sales: Tampa (+5.4%) and Las Vegas (+0.7%).

Luxury homes are defined as the top 5% of listings by price in a given market. Values are three-month rolling aggregates ending on the date shown, e.g. November 2023 spans September, October, and November 2023. Data does not include the three months ending December 31.

17. Bidding wars fell in 2023

51.6% of homes had a bidding war in 2023, down from 54% in 2022. In general, bidding wars have been dropping as mortgage rates have increased. This has been especially pronounced in pandemic boomtowns.

In many markets, bidding wars were virtually nonexistent. “Due to high mortgage rates and low competition, buyers didn’t feel as much pressure to compete,” notes Desiree Bourgeois, a Detroit Redfin agent. “Sellers need to know that buyers are less tolerant of an overpriced home.”

- Fort Worth (-23%), Austin (-17%), and San Antonio (-15.6%) saw the largest decreases in bidding wars year over year.

The top five metros with the highest percentage of bidding wars in 2023

| Metro | % of homes with bidding wars |

|---|---|

| Providence, RI | 69.1% |

| Montgomery County, PA | 68.7% |

| San Jose, CA | 68.1% |

| Oakland, CA | 67.9% |

| Boston, MA | 67.8% |

Redfin defines a bidding war as when a home faces at least one competing bid.

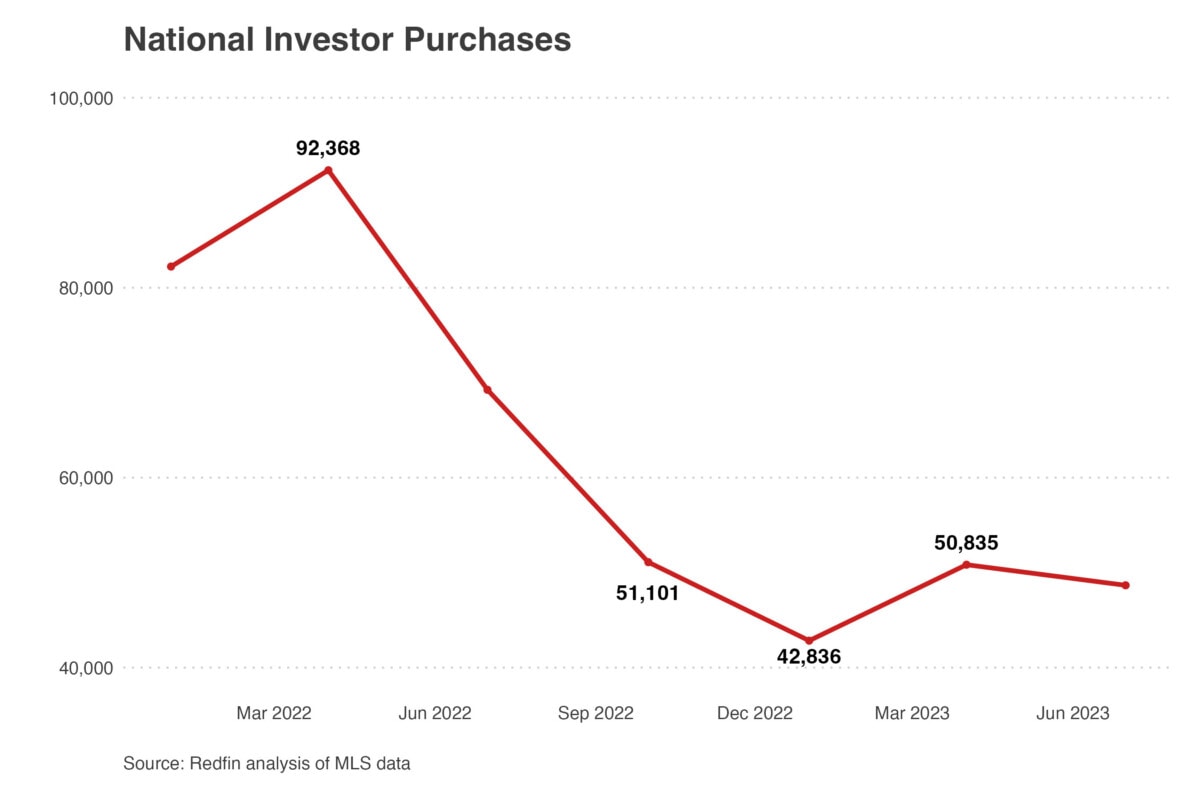

18. Investors purchases dropped at a record rate

Investor purchases plummeted by a record 48.6% year over year in the first three months of 2023, which followed a 46.2% fall at the end of 2022. Both drops exceeded the previous 45.1% record fall during the 2008 subprime mortgage crisis. (Investor purchase records date back to 2000.) However, investor market share remained relatively stable throughout the year, hovering around 17%, below last year’s 19%.

The drop in purchases continued until the last quarter of 2023 but eased slightly as mortgage rates began to stabilize. Investor activity isn’t expected to rebound in the near future.

These sharp drops came just months after the record surge in investor activity that happened in the aftermath of the pandemic. In fact, all of the most dramatic falls occurred in the Sun Belt, where investor activity jumped the most post-pandemic.

Atlanta, one of the top metros for investors last year, saw a 60% decrease in investor purchases, the largest fall in the country – but things are starting to look up. “Following a decline for most of these past two years, investor activity has ticked up in Atlanta,” says Angie Lawson, a Redfin agent in Atlanta. “They’re now focusing more on buying land, flipping homes, and acquiring properties for rental income.”

Investors generally buy homes either to sell or lease and capitalize on low construction costs and high demand. However, when costs are high and demand is low, investors usually slow down purchases. That’s what happened this year; high mortgage rates, a lackluster rental market, and rising home prices left many investors with homes they couldn’t sell or rent.

- Multi-family homes continued to be the most popular among investors, with single-family homes coming in second.

- A record 40.5% of all investor purchases were starter homes (less than 1,400 square feet).

The top five metros with the largest investor market shares in 2023

| Metro | Average investor share |

|---|---|

| Miami, FL | 30.5% |

| San Diego, CA | 21.9% |

| Anaheim, CA | 21.8% |

| Cleveland, OH | 21.3% |

| San Francisco, CA | 20.9% |

Data is analyzed on a quarterly basis and includes all property types unless otherwise stated. Data is through September (Q3).