| In a recent investment note, Morgan Stanley analysts say that U.S. homeowners are the “strong hands” in the current real estate cycle because they have the financial capacity to hold onto an asset for an extended period, despite market volatility or downturns. The company explains this conclusion by offering several key data points about U.S. homeowners: |

|

| Our take |

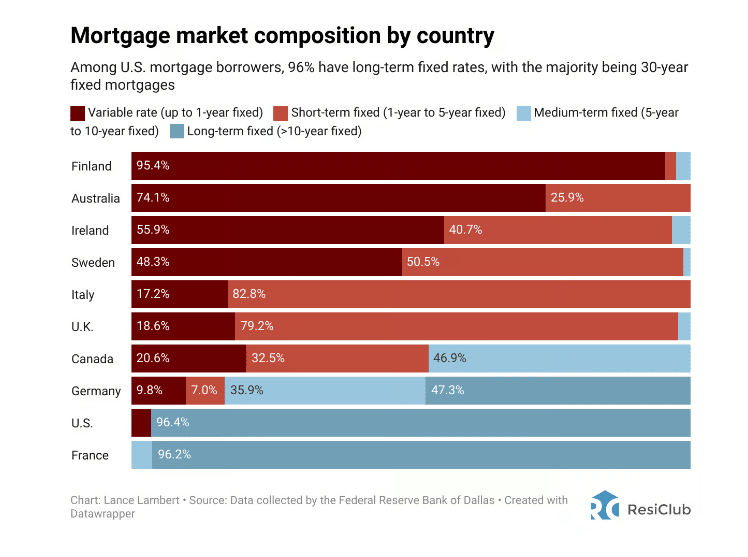

| Just look at that chart. 96% of U.S. mortgage borrowers have long-term fixed rates. Other than France, no other country comes close to us. This has given the U.S. homeowner a tremendous leg up. We suggest sharing this info with any prospective buyers. Since homeowners are this cycle’s “strong hands”, there will be a lack of homeowner distress, and few distressed sales. That’s one reason why national home prices remained stable despite mortgage rates doubling. |

Morgan Stanley: Homeowners are the “strong hands”