Where Homeownership Rates Are the Highest (and Lowest) in the U.S.

Source: Property Shark

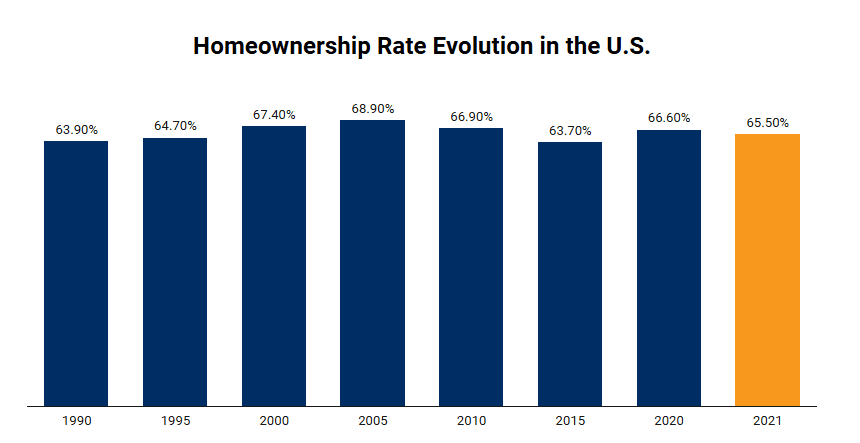

Homeownership remains a cornerstone of the American Dream, but in today’s challenging real estate market, affordability concerns have led many to question whether that dream is still attainable. Despite rising home prices and persistently high mortgage rates, the national homeownership rate has remained stable at 65.2%, according to the latest analysis from Property Shark and the U.S. Census Bureau.

However, this national figure hides significant regional disparities. While some states boast homeownership rates well above 70%, others struggle to break 60%. Let’s break down where homeownership is thriving—and where it’s lagging.

The States With the Highest Homeownership Rates

Some of the highest homeownership rates in the country are found in smaller, rural states where housing remains more affordable and long-term ownership is a tradition.

🏡 Maine – 74.4%

🏡 Michigan – 73.7%

🏡 Delaware – 73.6%

🏡 West Virginia – 73.5%

🏡 Vermont – 73.2%

These states share a few key characteristics: lower home prices, smaller urban populations, and a high percentage of longtime homeowners who have held onto properties for decades.

For example, West Virginia has some of the most affordable housing in the nation, with a median home price of just $152,000, far below the national average of approximately $417,000. With lower prices and relatively low property taxes, homeownership is accessible to a larger percentage of the population.

Similarly, Michigan ranks second in homeownership rate, despite the fact that Detroit’s homeownership rate is only 53.8%. This highlights a broader trend: statewide homeownership rates don’t always reflect individual city trends.

The States With the Lowest Homeownership Rates

On the other end of the spectrum, densely populated, high-cost states—particularly on the coasts—have some of the lowest homeownership rates. In these states, high home prices, competitive housing markets, and limited inventory have made ownership challenging for many residents.

🚨 Washington, D.C. – 39.1%

🚨 New York – 54.1%

🚨 California – 55.9%

🚨 Nevada – 60.4%

🚨 Massachusetts – 62.3%

It’s no surprise that Washington, D.C. has the lowest homeownership rate in the country at just 39.1%. As a city dominated by government employees, diplomats, and transient professionals, the rental market is strong, and home prices are among the highest in the nation.

New York (54.1%) and California (55.9%) also rank near the bottom due to skyrocketing home prices and a high percentage of renters in major metro areas like New York City, Los Angeles, and San Francisco. These cities are known for some of the most expensive real estate markets in the world, making homeownership unattainable for many residents.

Interestingly, Nevada (60.4%) and Massachusetts (62.3%) round out the list. Nevada’s real estate market is dominated by Las Vegas, where a large share of the population rents due to a strong hospitality industry workforce and frequent relocations. Massachusetts, home to Boston’s competitive housing market, has a similar issue—demand far exceeds supply, leading to high home prices and a strong rental culture.

Surprising Trends in Homeownership Rates

What makes this data particularly interesting is that some of the highest homeownership states don’t necessarily have the highest homeownership cities.

For example:

🔹 Michigan has the second-highest homeownership rate (73.7%), yet Detroit’s homeownership rate is just 53.8%—far below the national average.

🔹 Florida, Texas, and Arizona have cities with high homeownership rates, but statewide, they don’t even rank in the top 20.

🔹 West Virginia has one of the highest ownership rates in the country, despite having the lowest median rent in the continental U.S.—showing that low rents don’t necessarily discourage homeownership.

This suggests that factors like state policies, employment opportunities, and affordability play a much bigger role than simply rental costs in determining homeownership rates.

What This Means for Buyers and Sellers

This data serves as an important reminder that real estate is highly local. While national trends provide a broad overview, individual markets can vary widely, even within the same state.

For buyers, these insights can help identify affordable homeownership opportunities in areas where home prices are still reasonable. If you’re considering a move, states with high homeownership rates tend to offer more stability, affordability, and less competitive bidding wars.

For sellers, understanding these trends can help with pricing strategies and market positioning. In areas where homeownership is lower, demand for rental properties may be stronger, making it a good time to consider investment opportunities.

Final Thoughts

The stability of the national homeownership rate at 65.2% is reassuring, but regional disparities remain. While some states continue to see high ownership rates, others are struggling under the weight of high home prices and affordability challenges.

Whether you’re looking to buy, sell, or invest, it’s critical to stay informed on local market trends—because what’s happening nationwide may not reflect what’s happening in your neighborhood.

📞 Contact Abdo Pierre Faissal for unparalleled real estate service.

📧 [email protected] | 📱 310-620-1038