While February brought a 4.2% month-over-month increase in existing home sales, the broader picture remains clear: the housing market is still running well below its historical averages.

According to ResiClub’s analysis of NAR data, existing home sales fell 1.2% year-over-year, and if current trends hold, 2025 is on pace to end with 1 million fewer sales than a typical year before the pandemic.

🔎 What the Data Shows

-

🏘️ Sales are still below 2019 levels in every major U.S. housing market — except for Virginia Beach, VA and Louisville, KY.

-

📈 March saw more new listings than the same month in both 2023 and 2024 — but total inventory remains below pre-COVID norms.

-

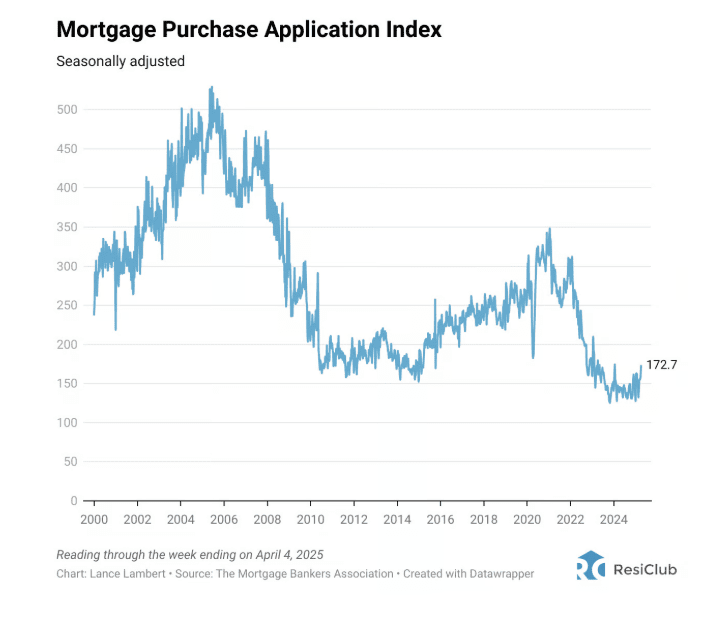

🧾 Mortgage purchase applications, a leading indicator for future home sales, have crept up in early 2025 — but remain well below normal activity, indicating persistent buyer hesitation.

In Los Angeles, we’re seeing the same pattern: more homes are being listed, but buyers aren’t jumping in as quickly — even with a bit more inventory to choose from.

🧠 Why Are Buyers Still Holding Back?

With 30-year fixed mortgage rates hovering around 6.6%–6.8%, many buyers remain cautious. While home prices are up and competition has cooled, affordability is still a challenge.

Add to that the economic uncertainty surrounding the recent tariff announcements from the Trump administration, and it’s clear why many buyers are waiting to see how things unfold before making a move.

📅 What’s Next?

The latest activity still reflects February conditions — pre-tariff announcements. We won’t begin to see the impact of new tariffs on consumer sentiment and affordability until March and April data start to roll in.

🗓️ Mark your calendar: March home sales data will be released on Thursday, April 24, and it may give us the first real insight into how buyers are responding to this new economic environment.

In the meantime, we’re likely to see a choppy, uneven housing market as the spring season unfolds. Some areas will benefit from more listings and price adjustments, while others may remain slow due to financing constraints.

💡 Takeaway for Buyers and Sellers in LA

-

Buyers: You have more leverage today than in past spring markets. Homes are sitting longer, and sellers are adjusting expectations. Use this moment to negotiate favorable terms before market conditions shift again.

-

Sellers: Price your home realistically. While inventory is rising, demand hasn’t fully rebounded yet — so overpricing could cause your listing to stagnate. Focus on making your home stand out with appealing finishes, strong marketing, and accurate pricing.

📞 Contact Abdo Pierre Faissal for unparalleled real estate service.

📧 [email protected] | 📲 310-620-1038