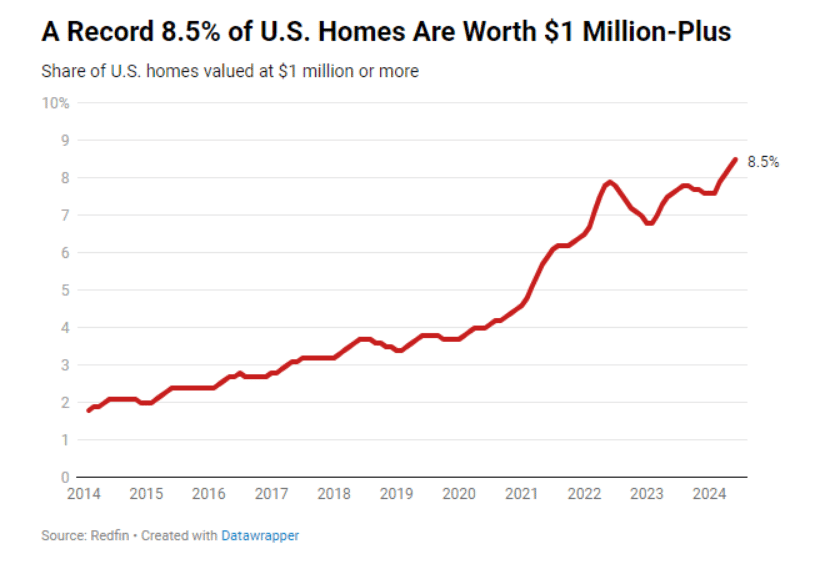

| 8.5% of U.S. homes are worth $1 million or more, the highest share of all time. That’s up from 7.6% a year ago and more than double the 4% share before the pandemic, according to Redfin’s analysis of past home values using public records and MLS data. |

| In raw numbers, 8,022,439 U.S. homes were worth at least $1 million in June 2024, compared to 7,155,393 in June 2023 and 3,427,869 in June 2019 (before the pandemic began). |

| Here are the metros that saw the biggest year-over-year jumps in the share of homes worth at least $1 million, as of June 2024: |

|

Our take |

| The share of homes worth $1 million or more is at a record high because home prices in general are at a record high. Nationwide, the median sale price was up 4% year-over-year in June. But we’re seeing even bigger jumps in the luxury market. The median sale price of luxury homes rose 9% year-over-year to a record $1.18 million in the second quarter. But we’re not seeing these trends everywhere. The percentage of homes worth a million plus isn’t increasing in important markets such as Austin or Houston. This is because widespread new construction in Texas has pushed up supply, putting a cap on price growth. There’s not as much construction going on in the markets where the share of million-dollar homes has increased. As we have said before, the best way any area can address rising home price growth is to build more. Tackle affordability by addressing supply. |

A record number of homes are worth $1M+