Dramatic Drop in Mortgage Rates: What It Means for Homebuyers and Sellers

Mortgage Rates See Biggest Drop Since December

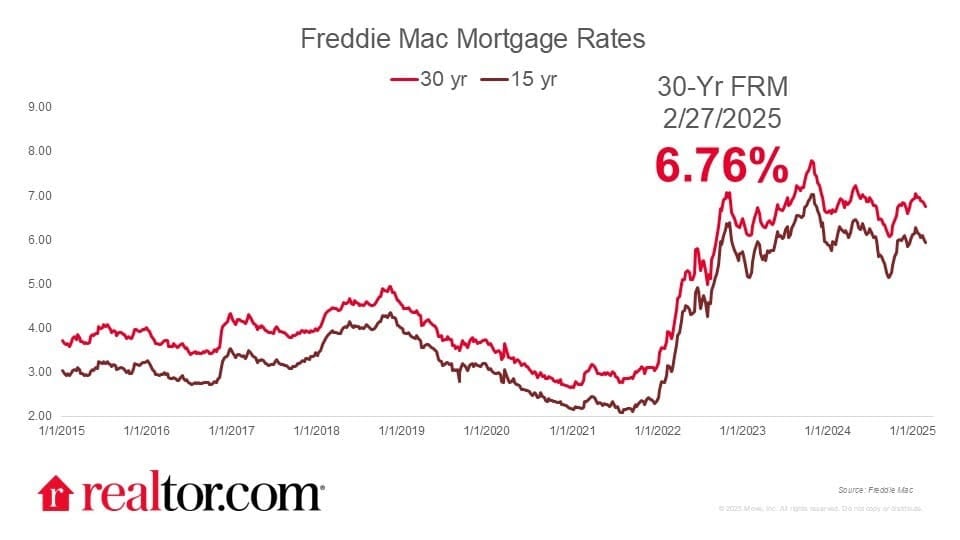

Mortgage rates have taken a noticeable dip, bringing some much-needed relief to prospective homebuyers. According to Freddie Mac, the average rate on 30-year fixed home loans fell to 6.76% for the week ending February 27th, down from 6.85% the previous week. Realtor.com notes that this is “the most dramatic decrease since mid-December.”

This drop in mortgage rates closely follows the movement of the 10-year Treasury yield, which is one of the most influential factors in determining mortgage rates. As of today, the 10-year Treasury yield stands at 4.26%, which is 76 basis points below the cycle high of 5.02% in October 2023. For reference, mortgage rates peaked at 8.03% in October 2023—so this latest decline is a step in the right direction for buyers looking for lower borrowing costs.

Why Are Mortgage Rates Falling?

The primary reason mortgage rates are dropping is due to declining bond yields, which reflect concerns about a slowing economy. Here are some key economic indicators that are contributing to this downward movement:

✅ Consumer Confidence Is Falling – The Conference Board’s consumer confidence index dropped more than expected, hitting its lowest level since June 2023. This suggests that many consumers are feeling less optimistic about their financial situation and the economy at large.

✅ Recession Fears Are Mounting – Investors are increasingly pricing in the likelihood of an economic slowdown or mild recession later this year. This expectation is pushing Treasury yields down, which in turn influences mortgage rates.

✅ The Federal Reserve’s Next Move Is Uncertain – While many expected multiple rate cuts from the Fed in 2024, recent economic data has led some experts to revise their expectations. While rate cuts could still be coming, their timing and extent remain uncertain.

What This Means for Buyers

If you’ve been waiting for mortgage rates to come down before making a move, this could be your window of opportunity. While rates are still historically high compared to the ultra-low levels seen during the pandemic, they have improved significantly from their 8% peak.

🏡 Buyers Now Have More Negotiation Power – With home prices stabilizing and sellers offering concessions, buyers can take advantage of lower rates while negotiating closing cost credits, interest rate buydowns, or even a lower sales price.

🏡 Lock in a Rate Before It Rebounds – Mortgage rates are extremely volatile, and bond yields can rise just as quickly as they fall. If you see a rate you’re comfortable with, consider locking it in sooner rather than later.

🏡 More Inventory Means More Choices – With active listings rising and homes sitting on the market longer, buyers have a larger selection and are facing less competition than they were during the frenzied housing market of 2021 and 2022.

What This Means for Sellers

If you’re thinking about selling your home, falling mortgage rates could bring more buyers back into the market—but don’t expect a sudden surge in demand overnight.

🏡 More Buyers Could Enter the Market – Lower rates make homeownership more affordable, which could result in an increase in showings and offers.

🏡 Be Strategic With Pricing – While demand is expected to pick up slightly, buyers are still cautious and price-sensitive. Homes that are priced competitively and in move-in-ready condition will likely attract more interest.

🏡 Consider Offering Incentives – Many sellers are successfully attracting buyers by offering rate buydowns or closing cost credits to make their home more appealing.

Our Take

Mortgage rates are closely tied to bond market movements, and right now, bond yields are declining because of economic uncertainty and concerns about a slowdown. While we can’t predict how long this trend will continue, buyers should take advantage of lower borrowing costs while they can.

For buyers, this is an excellent opportunity to secure a more affordable mortgage before rates potentially rise again. For sellers, it’s a sign that the market could see an increase in buyer demand, but competitive pricing and incentives will still be key to getting homes sold.

Bottom line: If you’ve been waiting on the sidelines, now is the time to act. Whether you’re buying or selling, getting ahead of these shifting market conditions could put you in the best possible position.

📞 Contact Abdo Pierre Faissal for unparalleled real estate service.

📧 [email protected] | 📱 310-620-1038