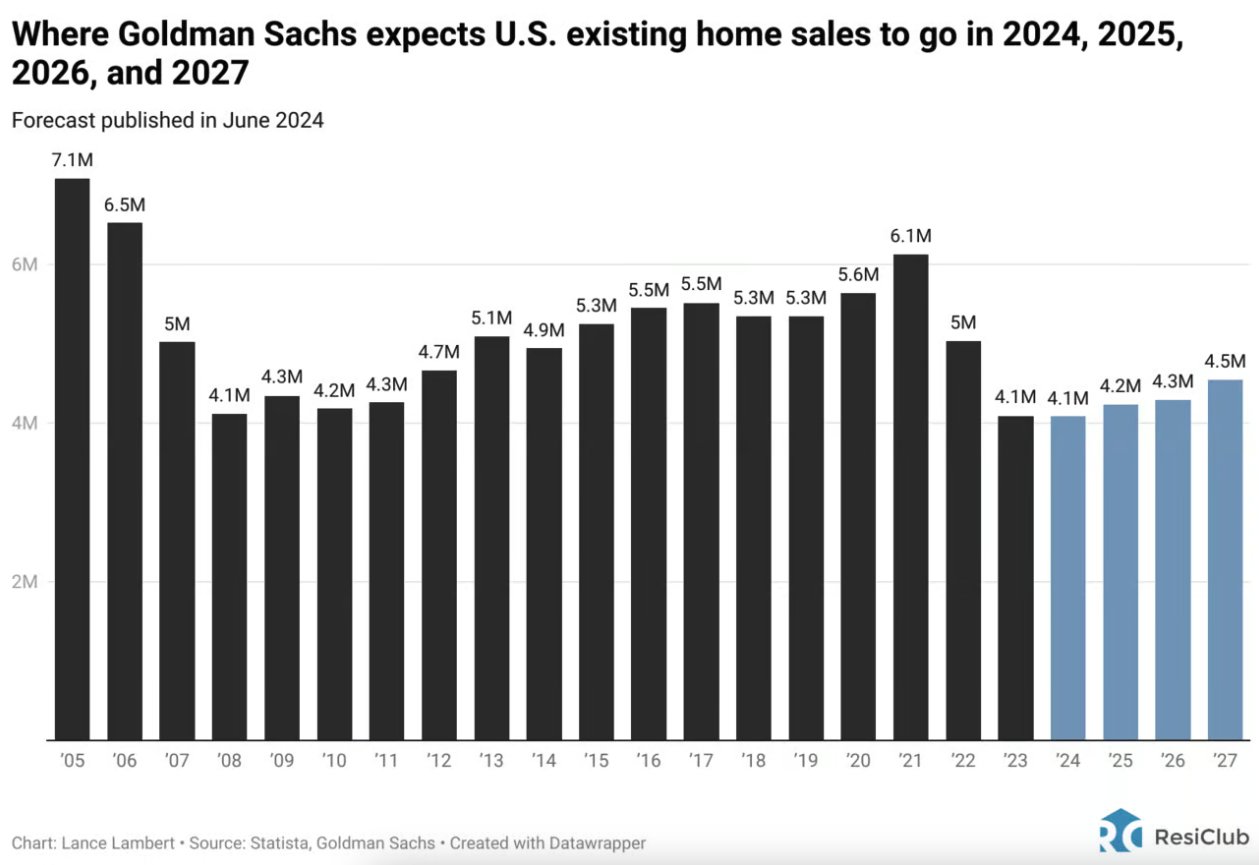

| Existing home sales will total around 4.1 million in 2024 and will rise to around 4.5 million in 2027. That’s according to the latest housing forecast from Goldman Sachs. For perspective, existing home sales totaled 6.1 million in 2021 (during the pandemic housing boom) and 5.3 million in 2019. For even more perspective, existing home sales totaled 4.09 million in the year 1978, when the U.S. population was roughly two-thirds of what it is now. |

| Here’s what else Goldman projects. |

|

Our take |

| Frankly, we’d rather bring back bell bottoms and pet rocks before we brought back these existing home sales numbers. If Goldman is right about these existing home sale numbers, it’s going to be a long slog. It’s not hard to see why this is happening. The lock-in effect may have subsided, but it hasn’t ended. Housing affordability has deteriorated to the point that many buyers and sellers alike have pulled back from the market. Many homeowners are staying put, rather than trading in their 3% mortgage rate for a 7% rate. We hope the Fed is watching because the economy is softening and it’s time to cut. |

Existing home sales nearing 1978 levels