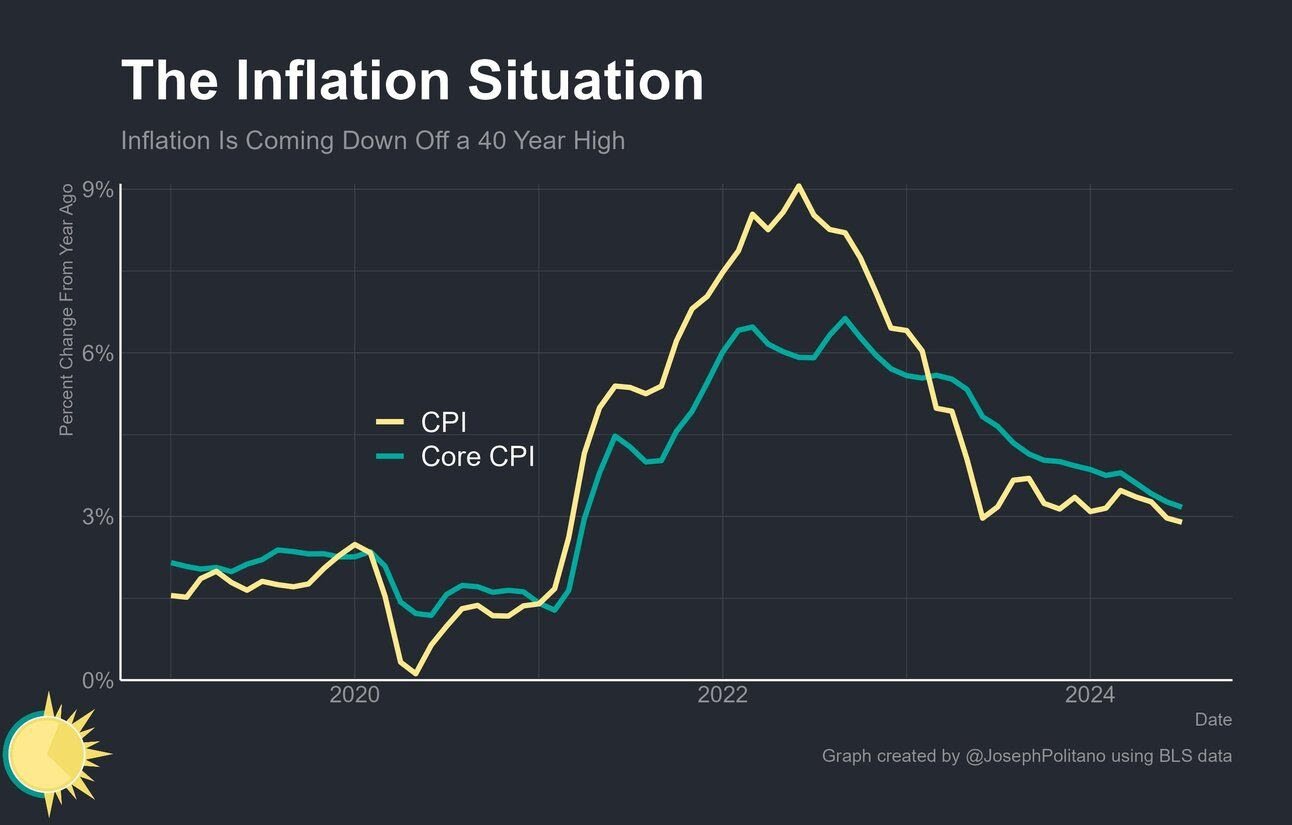

| Headline CPI Inflation declined to 2.9% year-over-year, the lowest level since March 2021. However, it did increase 0.2% month-over-month. That is from the latest inflation report from the Bureau of Labor Statistics. Here’s what else the BLS reports via Bloomberg. |

|

Our take |

| There are no certainties when dealing with markets, but with Core CPI rising at its slowest rate in three years and Headline CPI now under 3% YOY, it is extremely likely that the Fed will cut rates by at least a quarter point in September. This is exactly what the housing market needs. While we welcome this cut, we’re not Pollyannish about how it will affect transaction volume. The decline in mortgage rates at the tail end of the buying season is unlikely to boost new home sales meaningfully. We expect a slight bump in sales during the second half of 2024 at best but anticipate a larger bump in sales in 2025. Still, this is welcome news all around. |

Great news on inflation!