📉 Housing Market Update – March 2025 | Source: HousingWire & ICE Mortgage Technology

Over the weekend, a wave of confusion swept through social media claiming that homeowner delinquencies were spiking. But let’s be clear — this is not true for single-family homes, and as housing professionals, it’s important we separate fact from fiction.

According to the latest data from Intercontinental Exchange (ICE), one of the most respected providers of mortgage analytics, the national delinquency rate for single-family homeowners in February was just 3.53%. That’s:

- ✅ Up only 5 basis points from January

- ✅ Still 32 basis points lower than pre-pandemic levels

- ✅ Nowhere near the levels of real concern

📊 Where Did the Confusion Come From?

The misinformation stemmed from misinterpreting multifamily housing data as single-family homeowner data. While multifamily delinquencies have seen pressure due to tighter rental margins and higher operating costs, the single-family housing sector remains stable.

To be specific:

- 🏡 FHA-backed mortgages made up 90% of the year-over-year increase in delinquencies, yet they account for less than 15% of active loans.

- 📌 Roughly 1.91 million properties are currently 30+ days past due (but not in foreclosure), compared to 1.78 million a year ago — a modest increase, but far from alarming.

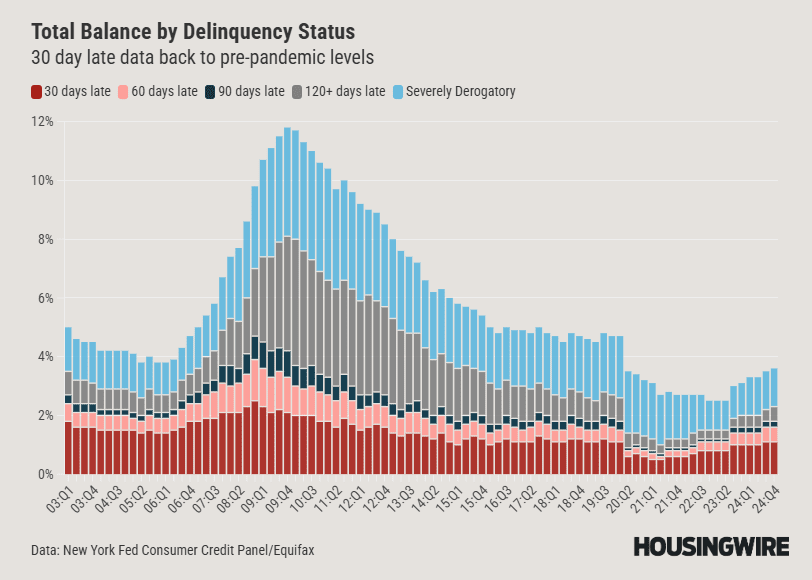

- 🔍 The rate of loans in severe derogatory status (the most distressed category) still hasn’t reached pre-COVID levels.

🔒 Homeowners in Los Angeles Are in a Strong Position

For buyers and sellers across Westside Los Angeles — including Brentwood, Pacific Palisades, Santa Monica, and Beverly Hills — the takeaway is this: the single-family housing market remains strong and secure.

Thanks to:

- 📉 Record-low delinquencies

- 💰 Fixed-rate mortgage dominance

- 🏠 High levels of homeowner equity

There’s no indication of distress selling or a foreclosure wave coming. This market is fundamentally different from 2008, where risky adjustable-rate loans and over-leveraging led to collapse. Today’s owners are in far better shape.

💡 Why This Matters for Buyers & Sellers

If you’re a homebuyer, don’t let viral posts scare you off. The housing market is still competitive, especially in Los Angeles. If you’re a homeowner thinking about selling, rest assured — current data supports strong property values and low distress across the board.

As an agent, it’s our job to guide clients with clarity, not speculation. Misinformation can move fast — but data-backed insights should move faster.

📞 Contact Abdo Pierre Faissal for unparalleled real estate service.

📧 [email protected] | 📲 310-620-1038

Let me know if you’d like this turned into a quick IG carousel or newsletter segment!