Recent data from the Mortgage Bankers Association, as reported by CNBC, reveals that mortgage applications to purchase a home fell by 4% last week compared to the previous week. This development highlights the ongoing cautious sentiment among buyers amid persistent high mortgage rates and economic uncertainty. Here’s a detailed breakdown of the key points from the report:

Key Market Data

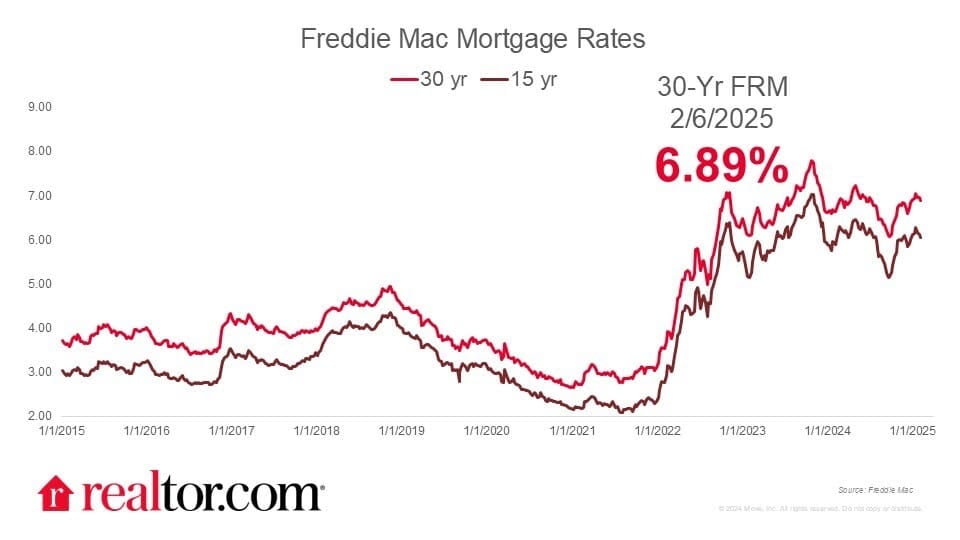

- Freddie Mac Rate:

The Freddie Mac rate for a 30-year fixed mortgage dropped by 6 basis points, landing at 6.89%. While this slight dip is encouraging, it underscores the fact that rates have remained largely unchanged in recent weeks, staying above the 7% threshold. - Loan Size Increase:

The average loan size for a purchase loan has risen to $447,300—the highest level since October 2024. This increase may reflect higher home prices and the need for larger borrowing to secure properties in today’s competitive market. - Refinance Applications:

Refinancing activity is on the rise, with applications increasing by 12% from the previous week and by 17% compared to the same week last year. This suggests that some homeowners are looking to take advantage of any available rate improvements, even though the overall environment remains challenging. - Historical Decline in Purchase Applications:

Mortgage applications for buying homes are now 39% lower than they were in February 2019, just before the pandemic began. This significant drop highlights the long-lasting impact of economic uncertainty and high borrowing costs on the homebuying process. - 10-Year Treasury Yield:

The yield on the 10-year Treasury currently stands at 4.438%, a figure that plays a crucial role in determining mortgage rates and overall borrowing costs for consumers. - Price Adjustments by Sellers:

In January, 15.6% of home sellers reduced their asking price, slightly up from 14.7% in January of the previous year. Despite these price cuts, median home sale prices continue to rise, a trend that may deter potential buyers who are already wary of affordability challenges.

Our Take

The latest data paints a complex picture for the spring housing market. On one hand, the modest dip in the 30-year fixed mortgage rate suggests some relief for buyers. However, with rates still lingering above 6.8% and overall mortgage applications for home purchases down by nearly 40% compared to pre-pandemic levels, many buyers are opting to stay on the sidelines. The rising average loan size indicates that, for those who do enter the market, the stakes are higher. Meanwhile, increased refinancing activity reflects an attempt by current homeowners to manage their mortgage costs amid high rates.

Despite a slight uptick in price cuts by sellers, overall median home sale prices are not showing a significant decrease, further emphasizing the affordability squeeze. The combination of high borrowing costs, stagnant rates, and economic uncertainty suggests that the outlook for the spring housing market remains challenging. Buyers may benefit from a broader selection of properties as homes linger on the market longer, but cautious financing and strategic negotiations will be crucial in this environment.

Contact Abdo Pierre Faissal for unparalleled service in buying or selling high-end properties.

📞 310-620-1038 | ✉️ [email protected]