📉 Mortgage Rates Decline for the Seventh Straight Week

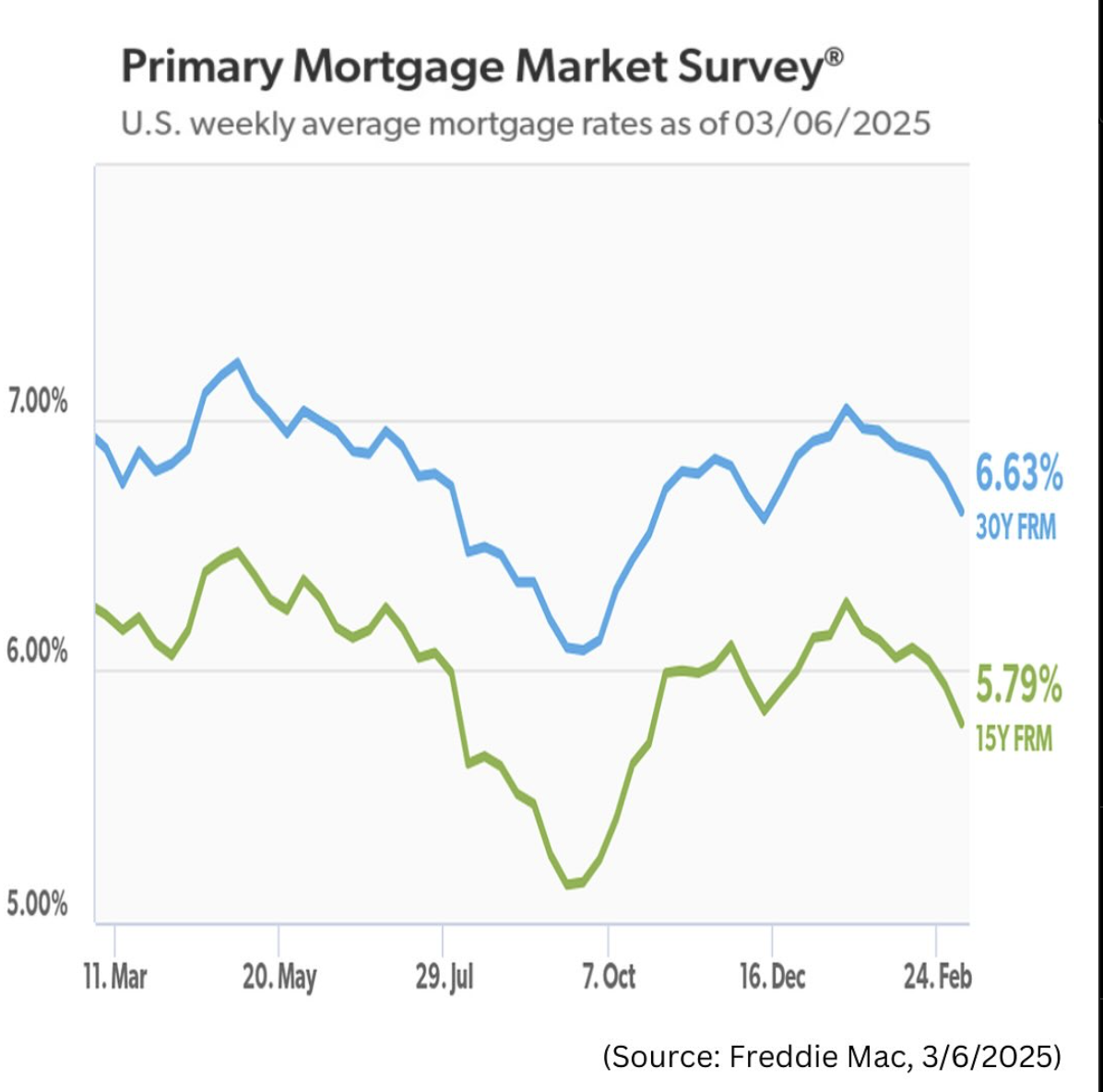

Spring is bringing some relief to homebuyers as mortgage rates continue to drop, marking the seventh consecutive week of declines. According to Freddie Mac, the average 30-year fixed mortgage rate fell to 6.63% for the week ending March 6, down from 6.76% the previous week.

Although rates remain higher than historical norms, they are still well below the 7%+ peak seen in mid-February. This shift has been driven by a combination of economic uncertainty, lower global oil prices, and increased investor demand for bonds following trade tensions caused by President Donald Trump’s tariffs on Canada and Mexico.

🏠 Key Market Updates:

- Mortgage rates: 6.63% (down from 6.76% last week)

- Year-over-year change: Down from 6.88% in March 2024

- Refinance applications: Up, now making up 44% of mortgage activity

- Home listing prices: Down 0.3% year-over-year

- Total inventory of homes for sale: Up 27.6% year-over-year

- Homes are staying on the market longer, taking four more days on average to go under contract than a year ago

📉 Mortgage Rates Drop – But Will It Last?

The recent dip in mortgage rates is welcome news for prospective homebuyers and current homeowners looking to refinance, but most experts caution that significant rate relief may not be on the horizon.

Realtor.com® Senior Economist Joel Berner explains that stubborn inflation and looming tariffs could keep mortgage rates elevated through the rest of the year. While the Federal Reserve has signaled that rate cuts are coming in 2025, they are unlikely to make dramatic moves anytime soon.

“We do not anticipate significant relief from high mortgage rates in the near future because of inflation remaining stubbornly high,” Berner says.

Even with these economic factors at play, the recent decline in rates has already sparked an increase in refinancing applications, showing that buyers and homeowners are acting quickly in response to lower borrowing costs.

🏡 Housing Market Trends: Prices, Inventory, and Sales Activity

Beyond mortgage rates, home prices and inventory levels are seeing major shifts that could impact buyers and sellers this spring.

📊 Home Prices & Listings

- The median list price of homes declined 0.3% YOY, marking the 40th consecutive week where home listing prices have remained flat or declined.

- Sales prices are rising due to strong demand for high-end properties, while lower-priced homes remain sluggish.

- New listings are up 0.1% year-over-year, marking the eighth consecutive week of listing growth.

📈 Active Inventory is Growing

One of the biggest trends to watch is the growth in available homes for sale:

- The total number of active listings has surged 27.6% year-over-year, giving buyers more choices than in recent years.

- Homes are taking longer to sell, sitting four days longer on the market than last year.

Realtor.com Senior Economic Data Analyst Hannah Jones points out that sellers are more flexible than before, offering price reductions and incentives to close deals:

“While buyers may see unaffordable housing costs at first glance, sellers are likely more flexible than in years past.”

🤝 What This Means for Buyers & Sellers

For Buyers:

✅ Lower mortgage rates give you more purchasing power, meaning your monthly payment is now slightly lower than it was just a few weeks ago.

✅ Inventory is growing, giving you more homes to choose from and less competition.

✅ Sellers are more willing to negotiate, offering price reductions and concessions—a major shift from previous years.

For Sellers:

🔹 Homes are staying on the market longer, so pricing aggressively and competitively is key.

🔹 Consider offering incentives like rate buydowns or closing cost assistance to attract buyers.

🔹 Luxury homes are selling faster, while demand for entry-level homes is lagging—adjust your strategy accordingly.

📅 Looking Ahead: What’s Next for the Housing Market?

With spring homebuying season ramping up, the big question is whether lower mortgage rates will spur more demand.

📉 Mortgage rates are expected to stay in the mid-6% range, but don’t expect a major drop below 6% anytime soon.

📈 Home inventory is rising, giving buyers more negotiating power and increased options.

⚖️ The market is shifting toward balance, meaning that both buyers and sellers will have opportunities to succeed this spring.

If you’re thinking about buying or selling a home, now is the time to act strategically to take advantage of the shifting market.

📞 Contact Abdo Pierre Faissal for unparalleled real estate service.

📧 [email protected] | 📱 310-620-1038