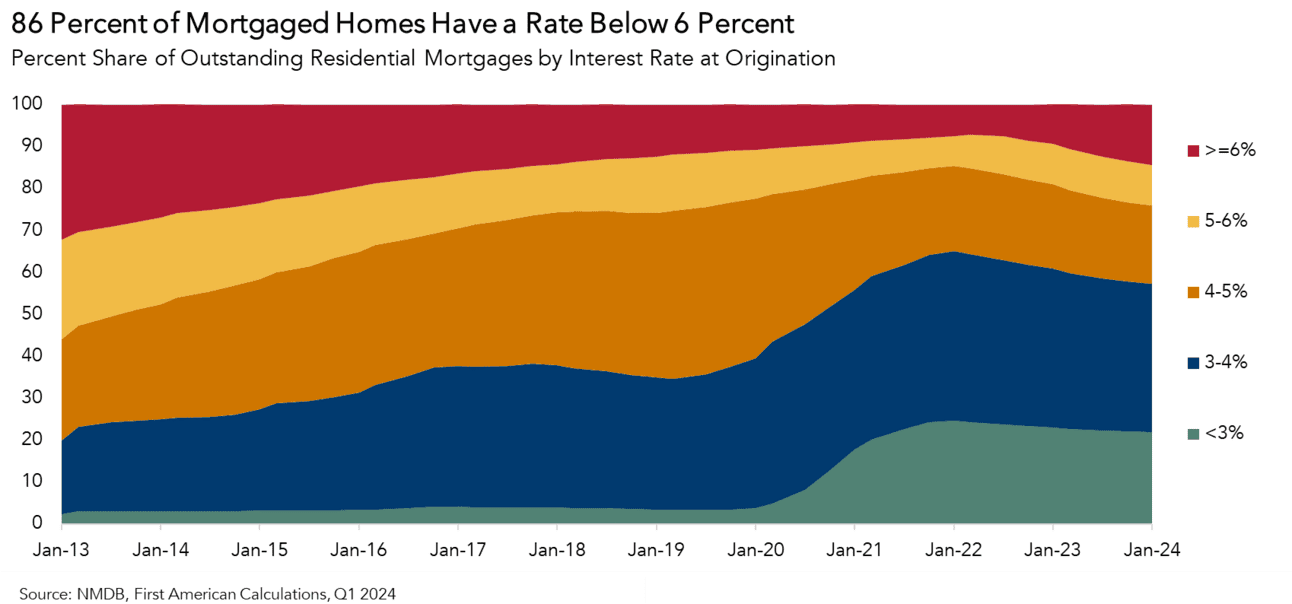

| 85.6% of mortgaged homes have a rate below 6%, down from the peak of 92.8% in Q2 2022. That’s one of the central conclusions revealed by the Federal Housing Finance Agency’s (FHFA) latest update on residential mortgages. Here’s what else the agency reports: |

|

| Our take |

| That 85.6% of mortgaged homes with sub-6% rates is the reason why many experts feared that homeowners wouldn’t list their properties for sale this year. Well, we are seeing some movement. While the “lock–in” effect hasn’t subsided entirely, new listings have spiked by nearly 10% year-over-year. But our big takeaway from this report is that current mortgage holders are doing great. They have a high credit score on average, their LTVs are great, the number of outstanding ARMs is very low, and nearly all of them are flush with equity. Current homeowners are sitting pretty! |

Mortgages with rates below 6% are falling